This post was written by Portland lawyer Cynthia Newton. She previously shared her concerns about commercial truck operators. Today’s post is about the insurance gap faced by bicycle users. It’s an issue we’ve covered previously here on BikePortland, but it’s so important we felt it was worth re-upping.

This is one of those things that’s not pleasant to think about, but important to know.

Bicycle riders and walkers who are involved in a collision with the driver of a motor vehicle often suffer serious injuries, requiring emergency medical care, surgery, hospitalization and short or long-term disability. Many Oregon drivers carry the minimal automobile insurance limits of $25,000. Serious injuries combined with this minimal amount of coverage combine to create a gap between the funds needed to pay medical expenses and to be fully compensated for lost income and non-economic damages. Put more simply: The injured’s damages exceed the at-fault driver’s insurance coverage.

As lawyers who work with bicycle riders, we see the consequences of this situation far too often.

The victim’s own automobile insurance Personal Injury Protection (“PIP”) coverage and Underinsured Motorist (“UIM”) coverage play a key role in providing financial relief and compensation. Here’s why PIP and UIM coverage are so important to Oregon’s vulnerable road users and why buying more of each may be worth the extra pennies:

Take, for example, Joe, one of our seriously injured clients who was commuting by bicycle in a bicycle lane when a minivan driver, suddenly and without warning, turned right directly in front of him — a the classic “right hook.” In the resulting collision, Joe broke his foot and leg. An ambulance took him to the emergency room where doctors took x-rays and fitted him in a cast. Several days later his orthopedic surgeon placed pins in his foot to hold the bones in place. After five months of painful physical therapy his surgeon recommended another surgery to remove the pins which were impeding mobility. He was disabled and unable to work for 12 weeks immediately after the collision and for another month after the second surgery.

Joe’s medical bills were $85,899.33. His income loss $20,000. His non-economic damages for pain and suffering, loss of enjoyment of life and permanent limitations, are at least $100,000. The driver who struck Joe had Oregon minimal liability coverage limits of $25,000/$50,000 creating the obvious problem: With over $100,000 in economic losses and even greater non-economic losses, using these funds alone, Joe will not be adequately compensated by the at-fault driver’s $25,000 in liability coverage.

Here’s a crash course on how auto insurance coverage works in Oregon…

Personal Injury Protection (PIP)

In Oregon, medical bills to care for a bicycle rider’s injuries caused by a collision with a motor vehicle operator are paid by insurers in this order: 1) the bicycle rider’s own automobile insurance Personal Injury Protection (“PIP”) coverage, if any; 2) the rider’s health insurance, if any; and 3) the driver’s automobile insurance under the policy’s PIP coverage.

Under-insured Motorist Coverage (UIM)

Oregon auto policies also include UIM. UIM coverage is designed to compensate the vulnerable road user for damages suffered for which the at-fault vehicle operator is responsible, yet not insured.

Minimal PIP and UIM Coverage Requirements

Insurers writing Oregon policies are required to write $15,000 of PIP medical coverage and 70% of lost income for up to one year (under certain circumstances) and $25,000/$50,000 per person/per collision of UIM coverage.

How PIP and UIM Compensate

Joe had $15,000 in PIP which was paid to the hospital for emergency and in-hospital care. His health insurance paid next — about $40,000 of the remaining $70,000. The driver’s insurance paid nearly $10,000 of its $15,000 PIP limits for Joe’s co-pays, deductibles and out-of-pocket expenses. After all three insurers’ payments, Joe has medical expense balances of $15,000. Joe’s PIP also paid him 70% of his lost income during the period when he was off work, paying 70% of his $20,000 lost income.

Any additional compensation, for past and future income loss or earning capacity, pain and suffering and permanent impairment, had to come from the driver’s liability coverage of $25,000 and Joe’s own UIM coverage, also $25,000. The total recovery was $50,000. (Seeking money damages from the at-fault driver was impractical in light of the driver’s financial situation and assets.)

Considering nearly $100,000 in medical expenses, $20,000 in lost income, months of pain, suffering and loss of enjoyment of life, and permanent impairment, Joe’s case could reasonably be valued at $250,000. Instead, he can recover only $25,000 from the mini-van driver. The at-fault driver maintained insurance to cover just 10% of the damage he inflicted.

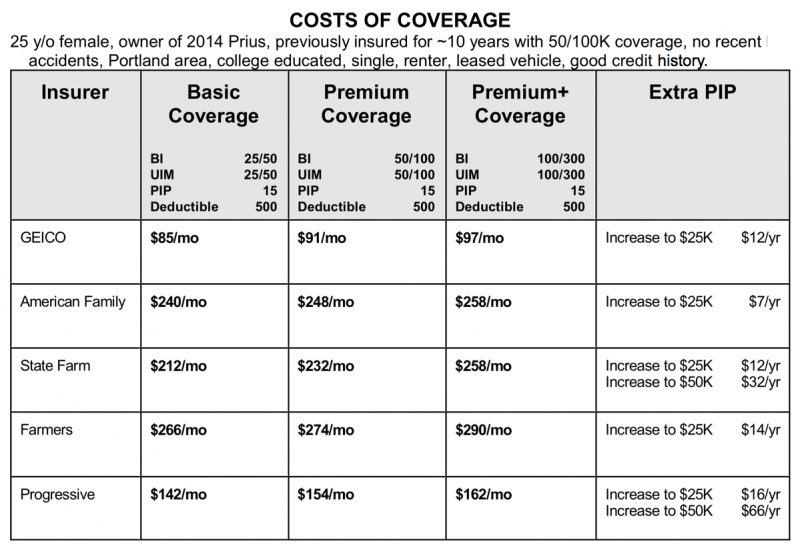

Bicycle riders wishing to guard against this risk of being under-compensated after an injury-causing collision can increase their policy’s PIP and UIM coverage limits. Our informal research shows that increasing these limits can cost relatively little in light of the considerable benefits they provide when a rider, vulnerable to the effects of a collision with a motor vehicle operator, is injured. We asked five auto insurers what it would cost for a 25-year-old female Portlander who owns a Prius and had been insured for 10 years with good credit and no history of collisions, to increase her PIP and UIM coverage.

This table summarizes our findings:

The table shows that this bicycle user can increase her PIP from $15,000 to $25,000 for between $12.00 and $16.00 per year. She can increase her PIP to $50,000 for between $32.00 and $66.00 per year.

One advantage to having more PIP coverage available to pay medical bills is that while many health insurers control the providers its insureds can see for treatment, PIP has no such restrictions. Also, PIP has no co-pays or deductibles and the medical provider is required to accept payments set by statute and write off the balance.

That same policyholder can increase her UIM coverage from the basic $25,000 to $50,000 for between $6.00 and $20.00 per month and to $100,000 for between $12.00 and $46.00 per month. Additional UIM coverage is then available to compensate the rider more fully for unpaid medical expenses, lost income and non-economic losses. Since legislation effective January 1, 2016, UIM coverage “stacks” or sits on top of the driver’s liability coverage. (For more about HB 411 see coverage on BikePortland.)

Insurers aren’t required to tell their customers about the availability of higher PIP and UIM limits. And, at these prices they may have little incentive to do so.

Unfortunately, in many cases, whether someone injured biking or walking will or will not be compensated fully will depend on his or her own automobile coverage. While this may be unfair, until legislation is passed requiring higher automobile user liability limits, drivers won’t have enough coverage to compensate those they seriously injured. According to one 2015 study, 12.7 percent of Oregon drivers were uninsured. Many more, we find, are under-insured.

Until the legislature takes action to help protect bicycle users from uninsured — and under-insured — drivers, Oregon’s vulnerable road users should consider whether they can pay a bit more to secure higher PIP and UIM limits to provide themselves some measure of self-protection.

— Cynthia Newton is a partner in the law firm of Thomas, Coon, Newton & Frost. TCN&F is also a BikePortland sponsor.

Never miss a story. Sign-up for the daily BP Headlines email.

BikePortland needs your support.

The post Walk or roll on Portland streets? You need more personal injury insurance protection appeared first on BikePortland.org.

from Latest headlines from BikePortland http://ift.tt/2Ducit0

No comments:

Post a Comment